Bangladesh Property Market 2025: Overall Scenario and Recent Trends

Bangladesh’s property market has been experiencing steady growth, fueled by rapid urbanization, infrastructure development, and increased investment opportunities. With a rising population and growing middle class, the demand for residential and commercial properties continues expanding. Dhaka remains the focal point of real estate activity, but other cities like Chattogram, Sylhet, and Khulna are also emerging as key investment destinations.

The market is evolving with changing buyer preferences, technological advancements in real estate transactions, and government policies promoting housing and development projects. While challenges like economic fluctuations, high construction costs, and loan interest rates persist, the sector’s long-term potential remains strong.

Key insights into the Bangladesh Property Market

1. Mirpur Is the Most Popular Location for Property Sales in Dhaka

Mirpur has emerged as a real estate hotspot due to its affordability, rapid infrastructure development, and growing connectivity. The Dhaka Metro Rail (MRT Line 6) has significantly boosted Mirpur’s attractiveness, making commuting easier. More residential and commercial projects are being developed, leading to an increase in property listings. Compared to Gulshan, Banani, or Dhanmondi, Mirpur offers more budget-friendly options for middle-income buyers.

2. Used Property Sales are on the Rise

Due to high inflation and rising construction costs, many buyers are shifting their focus from new apartments to resale properties. Used properties often offer better locations and existing infrastructure, making them appealing to homebuyers. This trend also indicates a more active secondary real estate market in Bangladesh. Property flipping (buying, renovating, reselling) is also gaining popularity among investors.

3. Despite Challenges, the Real Estate Sector Looks Promising

Challenges:

- Economic fluctuations and inflation impact affordability.

- High interest rates on home loans slow down purchases.

- Regulatory changes and approval processes delay new projects.

Opportunities:

- Smart city initiatives and supportive government policies are creating new real estate opportunities.

- The increasing demand for affordable housing is driving real estate growth.

- More foreign investment and real estate financing options are boosting the market.

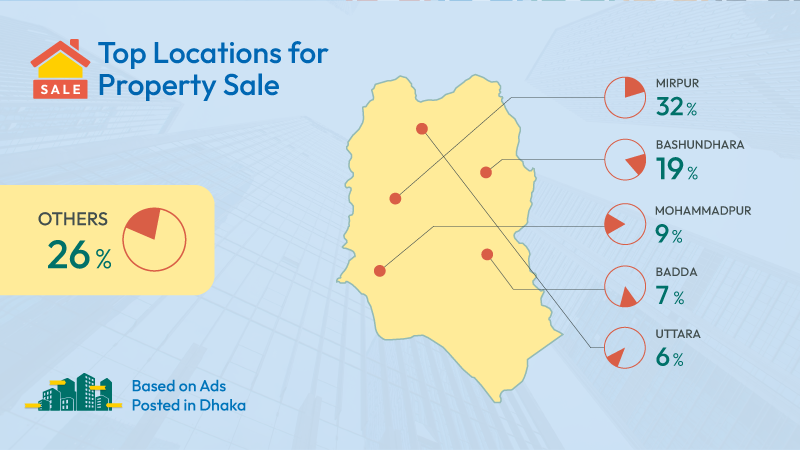

Top Locations for Property Sale (Inside Dhaka)

The Dhaka property market remains the most active in Bangladesh, with certain areas leading in property transactions. Mirpur dominates with 32% of shares, making it the most in-demand area due to affordability, metro rail connectivity, and infrastructure development. Bashundhara with 19% shares continues to be a high-end residential choice, popular among upper-middle-class buyers for its planned layout and modern facilities. Mohammadpur with 9% shares has seen growth due to its proximity to Dhanmondi and increasing apartment developments. Badda with 7% and Uttara with 6% shares continue to attract buyers due to their growing commercial and residential hubs. 26% of listings are spread across other parts of Dhaka, showing that interest exists beyond prime areas.

Top Locations for Property Sale (Outside Dhaka)

Outside the capital, real estate demand is strong in several key cities across Bangladesh including Rangpur, Dhaka Division, Khulna, Sylhet, and Chattogram. Rangpur leads with 19% of total shares, reflecting the increasing interest in Northern Bangladesh’s real estate due to growing economic opportunities. Chattogram with 14% shares, the country’s commercial hub, continues to see strong demand for both residential and commercial properties. Dhaka Division (excluding Dhaka City) with 12% shares shows significant growth, likely driven by expanding suburban developments and industrial zones. Sylhet with 10% shares remains a preferred destination, particularly for NBRs (Non-Resident Bangladeshis) investing in homes. Khulna with 8% shares is emerging as a key real estate market, possibly due to development in Mongla Port and industrial growth. 31% of transactions are spread across other regions, indicating a broad interest in real estate beyond major metropolitan areas.

Property Rent Trends in Dhaka

Dhaka’s property rental market is dominated by Gulshan, which accounts for 77% of listings, reflecting its status as a prime business and diplomatic hub. Banani (8%) and Basundhara (5%) also see steady demand, while Baridhara (3%) and Uttara (2%) cater to niche markets. Other areas make up just 5% of listings, highlighting a concentration of demand in high-end zones. However, mid-range and budget-friendly locations like Mohammadpur, Mirpur, and Banasree are gaining popularity among families and professionals. The expansion of metro rail, IT hubs, and co-working spaces is reshaping demand, with shared apartments and studio rentals becoming more common. As property prices remain high, renting continues to be a preferred option, ensuring a dynamic and evolving market.

Property Rent Trends Outside Dhaka

The rental market outside Dhaka is expanding with Sylhet leading at 43% of listing, followed by Chattogram (15%), and Dhaka Division (12%) as key hubs. Khulna (8%) and Rajshahi (5%) are showing steady growth as well. The demand is driven by urban expansion, industrialization, and improved connectivity. Chattogram, as a commercial hub, sees high rental prices in prime areas like GEC Circle and Agrabad, while Sylhet’s market fluctuates due to expatriate investment. Khulna and Rajshahi offer lower rental costs but are gradually growing due to industrial and educational development.

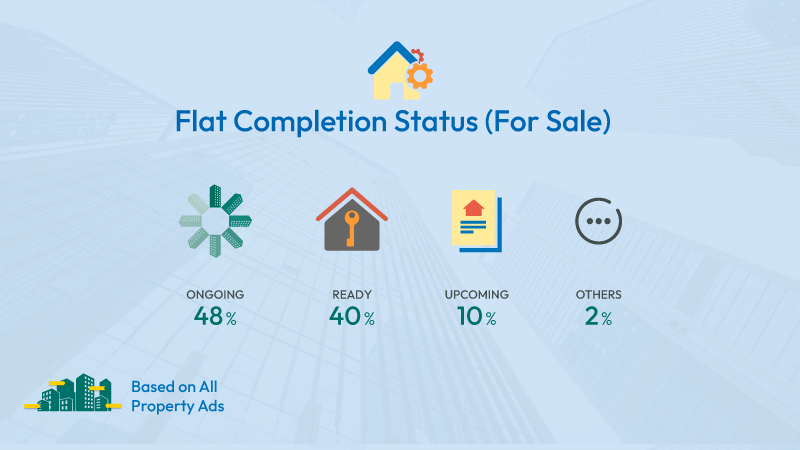

Insights from the Flat Completion Status (For Sale)

The real estate market is thriving, with 48% of listed flats still under construction, signaling active development and investment potential. Ready flats make up 40% of the listings, ensuring ample options for immediate buyers. Meanwhile, 10% of properties are in the early development stages, indicating a steady but controlled pipeline of future projects. A small 2% fall under unspecified categories, likely including recently completed or uniquely positioned flats.

Top Searched Locations for Buying Properties (Inside Dhaka)

Property buyers in Dhaka show the highest interest in Basundhara (25%) and Gulshan (20%), reflecting their appeal as prime residential and commercial hubs with developed infrastructure and amenities. Mirpur (12%) also ranks highly, followed by Mohammadpur (10%) and Purbachal (4%), indicating growing demand in these areas. The remaining 29% is spread across other locations, suggesting that while a few key areas dominate searches, there is still interest in various parts of the city.

Top Searched Locations for Buying Properties (Outside Dhaka)

Interest in property purchases outside Dhaka is notably high, with Khulna (15%) and Sylhet (11%) emerging as the top searched locations. Rajshahi (10%) and Chattogram (8%) also attract considerable attention, while Rangpur accounts for 6% of searches. However, the largest portion (50%) falls under ‘other’ locations, highlighting a diverse range of preferences. This broad interest may stem from factors like lower property prices, new developments, or a desire for quieter, less urbanized living spaces compared to Dhaka.

Available Property for Sale by Price Range

The property market in Dhaka is largely driven by high-end listings, with 42% of properties priced above 11K+ BDT per square foot. Mid-range options are also available, with 5-7K BDT (17%), 7-9K BDT (16%), and 9-11K BDT (10%) making up a significant portion of the market. Meanwhile, more affordable properties, priced below 5K BDT per square foot, account for 15% of listings. This trend suggests a strong demand for premium real estate, likely reflecting interest in well-developed residential and commercial spaces in prime locations.

Available Property for Rent by Price Range

The majority of rental properties fall within the 200-300K BDT price range, comprising 22% of available listings. Other popular segments include the 80-100K BDT range (15%) and the 60-80K BDT range (14%). Lower price ranges, such as <20K BDT, 40-60K BDT, and 20-40K BDT represent smaller portions of the market, making up 6%, 5%, and 4% respectively. Higher-end rental properties, such as those in the 400-500K BDT range, are less common, accounting for 4% of the listings. Meanwhile, a substantial 31% falls under ‘other’ categories, indicating a broad variety of rental options beyond the primary price brackets. This distribution suggests that while mid-to-upper-range properties dominate, there remains a significant market for both high-end and affordable rental options.

Conclusion

The real estate sector in Bangladesh is poised for continued growth, with increasing demand for affordable housing, commercial spaces, and sustainable developments. Government initiatives, improved financing options, and smart city projects are expected to drive further expansion. Although market uncertainties exist, the shift towards digital property transactions, rising foreign investments, and enhanced infrastructure will likely strengthen the property market in the coming years. Whether for investment or personal ownership, the Bangladesh real estate industry offers diverse opportunities for local and international buyers alike.